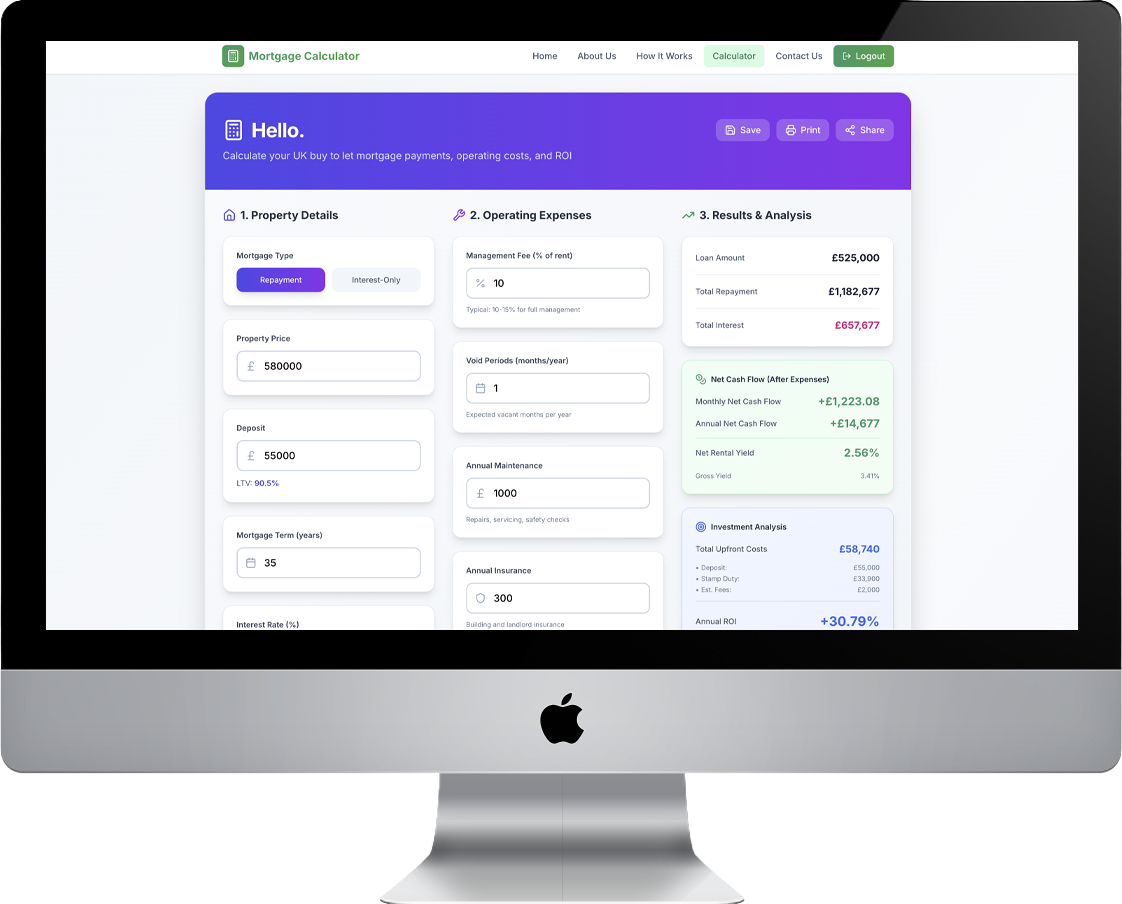

Mortgage Calculator – At Notch, we build digital tools that remove friction, increase clarity, and help people make smarter decisions. The UK property market is full of complexity, yet most online calculators barely scratch the surface. Investors and homebuyers are left guessing at affordability, rental performance, cash flow, and long‑term costs.

So we built BuyToLetMortgageCalculator.co.uk—a comprehensive, professional‑grade Mortgage Calculator designed for both buy‑to‑let investors and residential buyers who want accurate, data‑driven financial insight before committing to a property.

Our goal was simple: create a single tool that delivers the depth of analysis normally reserved for brokers, advisers, and spreadsheets—while remaining completely free to use.

Built to Solve Real Problems in Property Finance

When we began designing the platform, we studied how investors and homebuyers actually make decisions. The same issues came up repeatedly:

- Generic calculators only show monthly repayments

- No rental yield or cash flow modelling

- No ROI projections or break‑even timelines

- No buy‑to‑let stamp duty calculations

- No operating cost analysis

- No ability to switch between investment and residential scenarios

We built the calculator to solve all of these gaps in one place.

From the moment you enter a property price, deposit, and mortgage details, the platform generates a full financial breakdown—rental yield, ROI, cash flow forecasts, stamp duty, LTV, affordability, and interest‑only vs repayment comparisons—all drawn from the features outlined on the homepage.

Professional‑Grade Tools for Buy‑to‑Let Investors

Buy‑to‑let investors need more than a repayment estimate. They need to know whether a property is viable.

Our calculator includes:

- Rental Yield Calculator – gross and net yield percentages

- Cash Flow Projections – monthly and annual forecasts after expenses

- ROI Analysis – return on investment and break‑even timeline

- BTL Stamp Duty – including the 3% surcharge automatically

These features help investors evaluate opportunities with the same clarity used by portfolio landlords and advisers.

Comprehensive Analysis for Residential Buyers

Homebuyers need confidence before speaking to a broker or making an offer. The calculator provides:

- Monthly Payment Calculations – repayment and interest‑only

- Affordability Checks – based on deposit, income, and current rates

- LTV Calculator – understand deposit requirements and rate bands

- Stamp Duty Estimates – including first‑time buyer relief

This gives buyers a realistic understanding of what they can afford and how different mortgage structures affect long‑term costs.

How the Calculator Works

We designed the workflow to be simple, fast, and intuitive:

- Enter your email to launch the calculator

- Choose buy‑to‑let or residential mode

- Input property price, deposit, mortgage details, and (if relevant) rental income

- Instantly receive a full financial analysis including:

- Rental yield

- Cash flow

- ROI

- Stamp duty

- Monthly payments

- LTV

- Operating costs

- Break‑even timeline

The platform switches seamlessly between investment and residential modes, allowing users to compare strategies and test scenarios quickly—exactly as described on the homepage.

Why Notch Built This Tool

We built this calculator because property decisions deserve better data. Whether someone is buying their first home, analysing a buy‑to‑let, or building a portfolio, they should have access to the same level of insight professionals use.

Our principles were clear:

- Accuracy over approximation

- Clarity over jargon

- Depth without complexity

- Free access for everyone

The result is a tool used by thousands of investors and homebuyers across the UK, helping them avoid costly mistakes, compare opportunities, and make confident decisions backed by real numbers.

A Smarter Way to Analyse Property

BuyToLetMortgageCalculator.co.uk is more than a calculator—it’s a complete financial analysis engine for property buyers. By combining buy‑to‑let modelling, residential affordability, cash flow forecasting, and ROI analysis, it gives users the clarity they need before committing to a mortgage.

At Notch, we believe better tools lead to better decisions. This Mortgage Calculator is our contribution to a more transparent, data‑driven property market.